Card Connector Market – Global Industry Analysis and Forecast

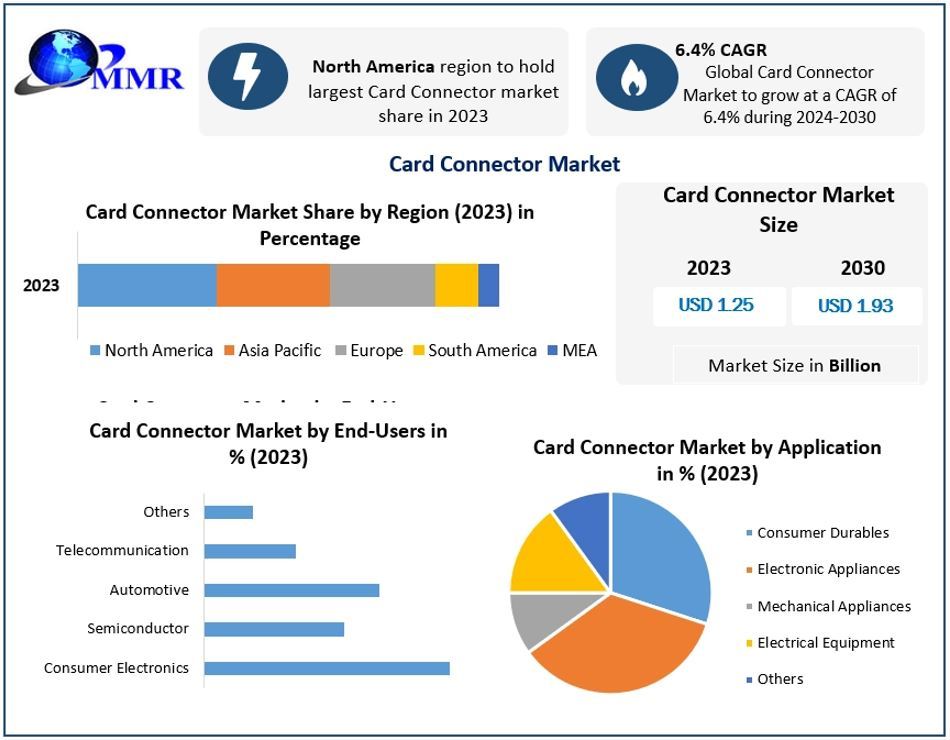

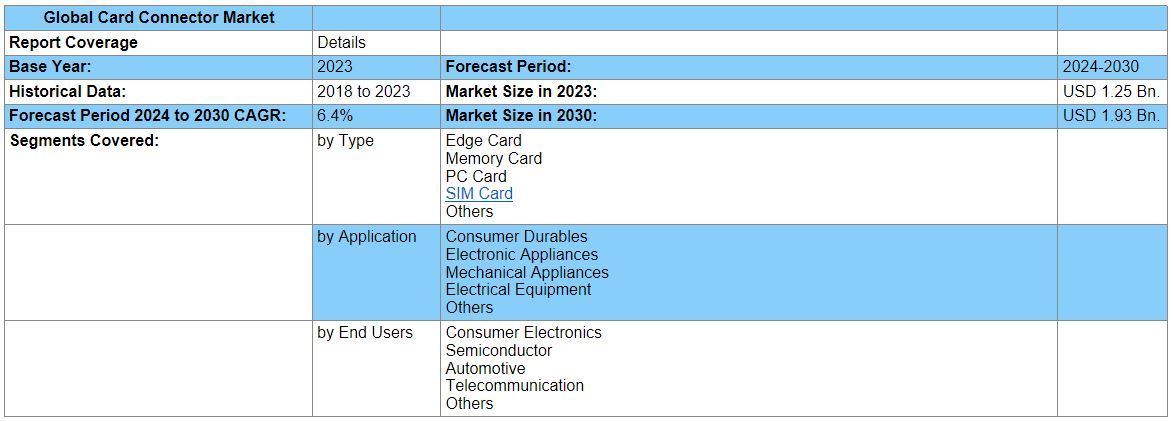

Global Card Connector Market size was valued at USD 1.25 Bn. in 2023 and the total revenue is expected to grow at CAGR 6.4% from 2024 to 2030, reaching nearly USD 1.93 Bn. in 2030.

Card Connector Market Overview

A card connector is a device used to establish a secure connection for transferring data between electronic components and holding various types of cards, such as SIM cards, memory cards, and PC cards. These connectors are essential in ensuring efficient communication in devices like smartphones, cameras, and other consumer electronics. The product uses key materials like plastics for the outer casing, metals like copper and gold for connections, and silicone for protection. These materials are important for making strong and reliable connectors.

The Card Connector Market is growing strongly due to the rising need for secure data transmission in sectors like consumer electronics, automotive, and healthcare. The market is growing due to the rise of smart cards and IoT devices, which need advanced connectors for reliable communication. Manufacturers are innovating and increasing the production of compact designs for smaller devices. As technology advances in speed and security, the market is set for continued growth, aligning with the shift toward digital and organized systems. As consumers continue to demand increased security, card connectors are expected to remain a key component in the growing market.

The Card Connector Market is growing significantly in regions like North America and Asia Pacific, driven by the rapid development of consumer electronics and the increasing adoption of IoT devices. Key countries include the United States, China, and Germany, where high demand for electronics boosts the card connector market. In the Asia Pacific region, China had the largest market share in 2023. The Chinese government has made significant investments to support the semiconductor and electronics industries. This importance on technology and local manufacturing of electronic parts has made China a key player in the global card connector market.

Card Connector Market Dynamics

The increasing adoption of smart cards is a significant factor driving the growth of the Global Card Connector Market

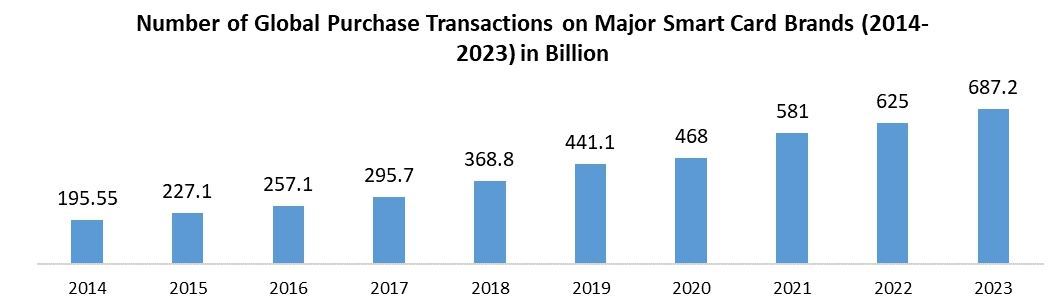

Smart cards are useful tools used for secure data storage, communication, and authentication across many industries. In finance, they play a key role in credit and debit card transactions. Transportation systems use them for ticketing and access control, while governments organize them for electronic identification, driving licenses, and passports. This broad adoption highlights that smart cards provide a secure and reliable way to transfer data and control access.

As the use of smart cards grows, there is a rising need for advanced card connectors that ensure secure and efficient connections. Manufacturers are continually innovating to meet these demands, developing connectors that support contactless transactions and are compatible with new smart card technologies. With smart cards becoming more common in various aspects of modern life, the Global Card Connector Market is expected to see strong growth in the future.

Additionally, the rise of Internet of Things (IoT) devices and embedded systems is also driving the growth of the Global Card Connector Market. IoT devices, such as smart home appliances and industrial sensors, have become essential in everyday life and various industries. These compact, interconnected devices rely on card connectors for efficient data exchange, power supply, and secure connections. Manufacturers are focused on creating connectors that work with a wide range of card formats and communication protocols, ensuring reliable data transfer in connected systems.

As per MMR analysis, nearly 4 out of 10 global card transactions in 2023 took place with a Visa-branded card. Roughly 266 billion purchase transactions worldwide involved Visa payment cards that year. That would equal approximately 0.72 billion Visa transactions per day in 2023. Visa smart cards utilize embedded chip technology for secure transactions. These chips require specialized card connectors for effective data transfer and communication with card readers and payment terminals.

The Growing Adoption of Compact Card Connectors is driving the Card Connector Market Growth

The increasing adoption of compact card connectors drives market growth. The contraction of electronic devices, such as smartphones, tablets, and wearables, has heightened the need for smaller, more space-efficient card connectors. Consumers expect smooth, lightweight, and portable devices, which boosts the demand for compact connectors. Manufacturers are responding to this trend by developing innovative solutions, such as embedded card connectors and low-profile connectors. These advancements in connector design cater to the demand for smaller and more aesthetically pleasing electronic devices.

With the advancement of technology, there is a growing need for faster data transfer rates in electronic devices. This requirement is in applications like high-resolution video streaming, augmented reality (AR), and virtual reality (VR). To meet these demands, the card connector market is witnessing a transition towards connectors capable of supporting higher data transfer rates. Manufacturers are investing in R&D to design connectors that effectively handle these higher data transfer rates.

The card connector market is facing several significant trends. The increasing demand for compact connectors, driven by the contraction of electronic devices, highlights the importance of space-efficient designs. The transition to higher data transfer rates addresses the need for faster and more data-intensive applications. As technology continues to advance, they expect further innovation in connector design, data transfer capabilities, and security features, leading to a more reliable and secure future that will drive revenue in the card connector market.

Ongoing Evolution of Security Threats possess significant challenge for the Market

As card connectors are integral to various secure systems such as financial transactions, healthcare records, and access control, they are prime targets for hackers to compromise data integrity. Cyberattacks, including data breaches, skimming, and tampering, continue to grow in complexity and frequency. Consequently, card connector manufacturers need to invest in R&D to create connectors that fight these advanced security threats. They must also adapt to the changing landscape of these threats. This challenge places immense pressure on the industry to maintain a high level of security, which is dynamic to maintaining consumer trust and regulatory compliance.

Card Connector Market Segment Analysis

Based on the Type, Edge Card Connectors, Memory Card Connectors, PC Card Connectors, SIM Card Connectors, and other connectors are segments covered in the Card connecter market. The Memory Card Connectors dominated the card connector market in 2023 and is expected to hold the largest Card Connector Market share over the forecast period. Memory cards are the most popular type of storage because they are used in smartphones, cameras, and many other gadgets. Their popularity comes from the growing need for digital content, like photos, videos, and apps. As individuals want to take and keep more high-quality media, the need for larger storage has increased. Memory cards are important for everyday use because they offer easy and portable storage options. This makes them important for modern technology.

Card Connector Market Scope:

Card Connector Market, by Region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and Rest of APAC)

Middle East and Africa (South Africa, GCC, and Rest of the MEA)

South America (Brazil, Argentina, and Rest of South America)

Top Companies/Manufacturers in the Card Connector Industry

North America:

1. Amphenol Corporation (US)

2. Molex Incorporated (US)

3. AVX Corporation (US)

4. Cinch Connectivity Solutions (US)

5. Vishay Intertechnology, Inc. (US)

6. Kycon, Inc. (US)

7. CW Industries (US)

8. 3M Company (US)

Europe:

9. TE Connectivity Ltd. (Switzerland)

10. HARTING Technology Group (Germany)

11. Eaton Corporation Plc (Republic of Ireland)

12. ERNI Electronics GmbH & Co. KG (Germany)

13. Rosenberger Group (Germany)

Asia-Pacific:

14. Yamaichi Electronics Co., Ltd. (Japan)

15. Hirose Electric Co., Ltd. (Japan)

16. Kyocera Corporation (Japan)

17. Japan Aviation Electronics (JAE) (Japan)

18. Foxconn Interconnect Technology (FIT) (Taiwan)

19. Deltronics (China)

Middle East & Africa (MEA):

20. Amphenol Corporation (South Africa)